"Spendwise" App: A Smart Solution for Budgeting and Financial Management"

Introduction

In the age of digitalization, managing personal finances has become more critical than ever before. With the wide array of expenses we incur daily, keeping track of our spending can be challenging. Fortunately, technology has offered us numerous tools to help us stay on top of our finances. One such innovative application that has gained significant attention is the "Spendwise"App. In this article, we'll explore the features and benefits of "Spendwise", making it an indispensable tool for budgeting and financial management.

- Streamlined Expense Tracking

The cornerstone of any effective budgeting strategy is to have a clear understanding of where your money is going. "Spendwise" simplifies this process by providing users with a seamless expense tracking system. With just a few taps, users can log their purchases and categorize expenses under specific budget categories, such as groceries, utilities, entertainment, and more. The app's intuitive interface ensures that even individuals with limited financial knowledge can use it with ease.

- Personalized Budget Creation

Creating and sticking to a budget can be daunting, but "Spendwise" makes it remarkably straightforward. The app allows users to set personalized budgets for various spending categories. Users can determine how much they want to allocate to each category per month, and "Spendwise" will keep them informed about their progress. Real-time updates and notifications ensure that users always know where they stand in terms of their budget goals.

- Goal Setting and Savings Planning

Apart from budgeting, the"Spendwise" App encourages users to set financial goals and provides them with the tools to achieve them. Whether it's saving for a vacation, an emergency fund, or a down payment on a house, "Spendwise" offers goal tracking features to help users monitor their progress. The app's ability to display actionable insights based on spending patterns empowers users to make smarter financial decisions and reach their targets faster.

- Bill Reminders and Payment Management

Missing bill payments can lead to late fees and adversely impact credit scores. "Spendwise" eliminates this risk by providing timely bill reminders and payment management features. Users can schedule bill reminders, ensuring they never overlook an important due date. Additionally, the app facilitates seamless bill payments through integrated payment options, making it a convenient one-stop-shop for managing financial responsibilities.

- Financial Reports and Analysis

Understanding your financial habits is crucial to making informed decisions. "Spendwise" offers comprehensive financial reports and analysis, presenting users with an overview of their spending patterns, trends, and areas where they can cut back. This data-driven approach allows users to identify potential areas of improvement and adjust their budgeting strategy accordingly.

- Bank-Level Security and Data Privacy

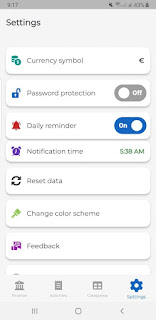

Security and privacy are paramount when it comes to financial apps. "Spendwise" takes this responsibility seriously by implementing bank-level security protocols to safeguard user data. All transactions and sensitive information are encrypted, and the app never stores personal financial credentials on its servers. Users can rest assured that their financial information remains confidential and secure.

Conclusion

In today's fast-paced world, managing finances efficiently is essential for a stress-free and financially stable life. "Spendwise" provides an all-in-one solution for budgeting, expense tracking, and financial management. With its user-friendly interface, personalized budgeting tools, and comprehensive financial analysis, "Spendwise" empowers users to take control of their money and work towards their financial goals with confidence. If you're looking for a smart and reliable app to manage your finances effectively, "Spendwise" is undoubtedly a must-have tool for your financial toolkit.

Comments

Post a Comment